Advocacy

The campaigns we run affecting our members:

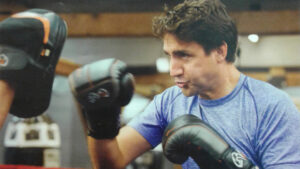

Knock Out Interest

Students in many provinces across Canada are working to eliminate interest on student loans. The Knock Out Interest campaign is being led by the British Columbia Federation of Students.

The British Columbia Federation of Students represents over 170,000 college and university students from across all regions of British Columbia. The Federation represents full- and part-time students at the college, undergraduate, and graduate levels. Together these students advocate for a well-funded system of post-secondary education that is affordable and accessible for all.

We’re launching this campaign because students in Canada are in a debt crisis.

Student debt in Canada has increased 78% since 1999. The total outstanding federal student loan debt is now $18.5 billion—and that number doesn’t even include debt from provincial student loans!

Because of ever-increasing tuition fees, students are graduating with debt loads that are higher than ever. Average student debt for an undergraduate degree in Canada is now over $30,000.

For students and families who have to borrow money in order to access post-secondary education, interest charged by the government adds thousands of dollars to the cost of their education.

For the average Canadian Student Loan, interest generates an additional $5,000 in costs!

This is for the same education as people who don’t need student loans. In effect, this interest is a tax on low- and middle-income students and families. The system unfairly punishes those who can’t afford to pay education costs up-front.

Charging interest on student loans isn’t just bad for individuals, it’s bad for the economy. A recent RBC study shows that student debt is holding recent graduates back in many important ways. Amongst recent graduates:

- 50% report not saving enough for emergencies

- 45% report delaying a home purchase

- 25% report that they are delaying having children

- 20% report that they are delaying marriage.

The solution is clear: we need to eliminate interest charged on student loans.

Eliminating interest on student loans will help to grow the economy by putting money back in the pockets of recent graduates as they join the workforce, which can then be spent on goods and services. It will also allow students and their families to focus less on their debt, and more on their careers and their lives.

It will help individuals, businesses, and the economy.

You can help make this happen!

Send an email right now to Prime Minister Trudeau urging him to eliminate interest on federal student loans.

Your quick action will go a long way. Visit www.knockoutinterest.ca

Fund It, Fix It

Tuition fees have skyrocketed over the last two decades, more than doubling since 2001. Where average tuition fees were $2,500 in 2000, they are over $5,900 in 2019; the average cost of obtaining a degree has increased by over $13,700 in tuition fees alone. The reason for this is clear: years of cuts and neglect have resulted in an underfunded system that makes up for funding on the backs of students and their families.

In recent years, the proportion of public funding to BC colleges and universities has dropped to less than 44% of total operating revenue, down from more than 80% in the 1980s and more than 90% in the 1970s; the proportion of tuition fee revenues now makes up 48% of institutions’ revenue — surpassing the proportion from government funding. This constitutes a massive divestment in public education for the current generation of young people compared to the support provided to those who attended college and university in past decades.

With the rising cost of tuition fees, add to those costs a multitude of new ancillary fees, ballooning housing costs, rapidly inflating transportation costs and other increased living costs, and it is easy to see why so many students are struggling. Compounding the squeeze on students and their families is the fact that wages have remained stagnant, and student financial assistance has not kept pace with need.

Our public post-secondary education system needs a renewed prioritization and investment from the BC government. With it, the government can freeze tuition fees at current levels and establish a plan to progressively reduce fees in the future. This action is absolutely necessary to help make life more affordable for BC students and their families.

How can we tell the next generation that they can’t afford to dream? When it comes to British Columbia’s post-secondary system, we need to fund it, and fix it, now.

Visit www.funditfixit.ca to take action

Fairness For International Students

For international students, studying in Canada is an opportunity to access education in a country that is consistently ranked one of the top countries for higher education globally. Unfortunately, Canada’s excellent reputation is being misused by governments and institutions to fill the gaps in post-secondary education funding with inflated and predatory tuition fees. Download our backgrounder to learn more.

In BC and most of Canada, international tuition fees are unregulated and can increase at any time, with no notice. Domestic student tuition fee increases are capped at 2% annually under the BC government’s Tuition Fee Limit Policy. Meanwhile, tuition fees for international students in BC are not covered in this policy and have increased by 64% since 2006 and by 594% since 1991.

Paying More Than Their Fair Share

Due to government underfunding, institutions have come to depend on the revenue they receive from increasing fees for international students as a way of balancing their institution’s budgets. However, unpredictable fees makes budgeting impossible for individuals and families, meaning some international students are forced to leave Canada before completing their studies. These figures illustrate that while international university students only account for one fifth of BC university enrolment, they contribute almost half of BC universities’ tuition fee revenue.

The Economic Benefit of International Students in Canada

Regulating international student fees is not just about keeping education affordable for all students, but also about recognizing the richness international students bring to BC society and protecting their economic contributions needed to build the BC of tomorrow. International students in post-secondary education pay significantly higher tuition fees than their domestic peers; in fact their fees generate a profit for each respective institution that is used to offset reduced public funding. Additionally, these students pay vast sums into the local economies across BC on such staples as housing, food, transportation, and entertainment.

For more info, visit www.wearebcstudents.ca/fairness_for_international_students

Period Promise

Period poverty, a person’s inability to access menstrual products due to financial limitations, is a real issue that affects people across the province and that local organisations struggle to address. According to the 2018 Confidence and Puberty Study by Always, Proctor & Gamble, almost a quarter of Canadian women report having struggled to afford menstrual products for themselves or their children, and 66% say that periods have kept them from participating fully in day-to-day activities of life.

WHAT’S THE PERIOD PROMISE?

The Period Promise is an initiative of the United Way of the Lower Mainland that aims to raise awareness around period poverty and highlight how providing access to free menstrual products increases access to employment, education and social engagement for people who menstruate. Having started as a donation drive initiative called Tampon Tuesday, Period Promise has grown to become an advocacy-based campaign encouraging businesses, organisations, and governments to provide access to free menstrual products.

The campaign has had two large successes: In 2019, The Ministry of Education announced that all public K-12 schools would have free menstrual products in washrooms by the end of that year and; in March 2021, a report was produced demonstrating the effects of period poverty on our communities and community members – the United Way has summarized a few of the key findings here.

For more information, visit https://www.wearebcstudents.ca/period_promise

Reconciliation Through Education

Indigenous students face issues with education attainment and participation in post-secondary education across Canada. Indigenous post-secondary attainment is not only an education issue, but has larger consequences for income inequality and patterns of chronic unemployment.

Education Attainment Levels in Canada

In recent years, despite the increasing proportion of Indigenous people with university degrees, the attainment gap with non-Indigenous people has been widening, not shrinking. The proportion of Indigenous people who have a university degree has more than quadrupled compared to 25 years ago, yet the gap between Indigenous and non-Indigenous people has more than doubled over the same period. These disparities show that there is still an issue with attainment and access to post-secondary education for Indigenous peoples in Canada.

Unemployment Based on Attainment Levels

The level of education attainment impacts employment. According to the 2016 Census, across Canada, unemployment rates decrease as educational attainment increases, particularly for Indigenous people:

Many of the disadvantages facing Indigenous peoples such as unemployment and lower incomes can be traced back to the gap in educational attainment between Indigenous and non-Indigenous people. In order for true reconciliation to be achieved, the government needs to take steps to reducing the attainment gap.

TRC Recommendations for Reconciliation Through Education

The Truth and Reconciliation Commission’s recommendations for post-secondary education focus on providing necessary funding to educate teachers on how to integrate Indigenous knowledge and teaching methods in the classroom. Education needs to be a top priority in the federal and provincial reconciliation framework. Investing in Indigenous education is a necessary step towards reconciliation and provides a pathway to stronger economic stability and reducing income inequality.

Join our campaign to make reconciliation through education a top priority for the BC government. Visit www.wearebcstudents.ca/reconciliation_through_education

Open Textbooks Now

The high cost of textbooks has become a serious obstacle to accessing post-secondary education in BC. The commercial textbook industry is making huge profits off students who are already facing ever-increasing tuition fees and student loan debt.

Since 2002, the cost of textbooks has nearly doubled. In fact, 26% of BC students choose to not register for a course due to textbook costs, which negatively impacts their academic career. There is a solution to this problem: the implementation of Open Education Resources (OERs).

What Are OERS?

OERs come in many forms: full courses, lesson plans, videos, exams, and textbooks. These are available in digital formats for free or in print at a very low cost. With traditional textbooks, instructors must choose between delivering the curriculum they feel is right for their students and delivering a lesson that mirrors the commercial textbooks. Through open textbooks, instructors can mix and modify their textbooks to emphasize the lessons they want to deliver, with ancillary resources available to improve the learning experience.

Who Makes OERS?

BCcampus, an agency of the BC government, is tasked with centralizing efforts to create and enhance open education resources in the province. In 2012 the government provided one million dollars to initiate the open textbook initiative, and added an additional one million in 2013 to further grow the project. Since that time, open textbooks have saved students over $9 million collectively through traditional, high-cost textbooks being replaced with OER options. More funding will result in more resources and save students money one class at a time! All it takes to expand the program is a commitment from instructors and administration to make saving students money a priority.

To learn more about BCcampus and to search the database of available resources, check out their website.

What Can I Do?

Join the online provincial conversation on OERs by following #textbookbrokeBC, and posting online your experience with OERs. You can also tweet your textbook receipt using the hashtag #textbookbrokeBC to share how the rising costs of textbooks are affecting you.

Talk to an instructor you think would be interested in adopting open education resources, or point them to your institutions library for information on OERs. You can also contact your students’ union if you’re interested in talking to your instructors, but would like more support getting started.